Renters Insurance in and around Dayton

Renters of Dayton, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Dayton Renters!

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected damage or catastrophe. And you also need liability protection for friends or visitors who might hurt themselves on your property. State Farm Agent Holly Hill is ready to help you handle the unexpected with reliable coverage for your renters insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Holly Hill can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Renters of Dayton, State Farm can cover you

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

The unexpected happens. Unfortunately, the possessions in your rented property, such as a TV, a laptop and a smartphone, aren't immune to smoke damage or theft. Your good neighbor, agent Holly Hill, is ready to help you figure out a policy that's right for you and find the right insurance options to help keep your things protected.

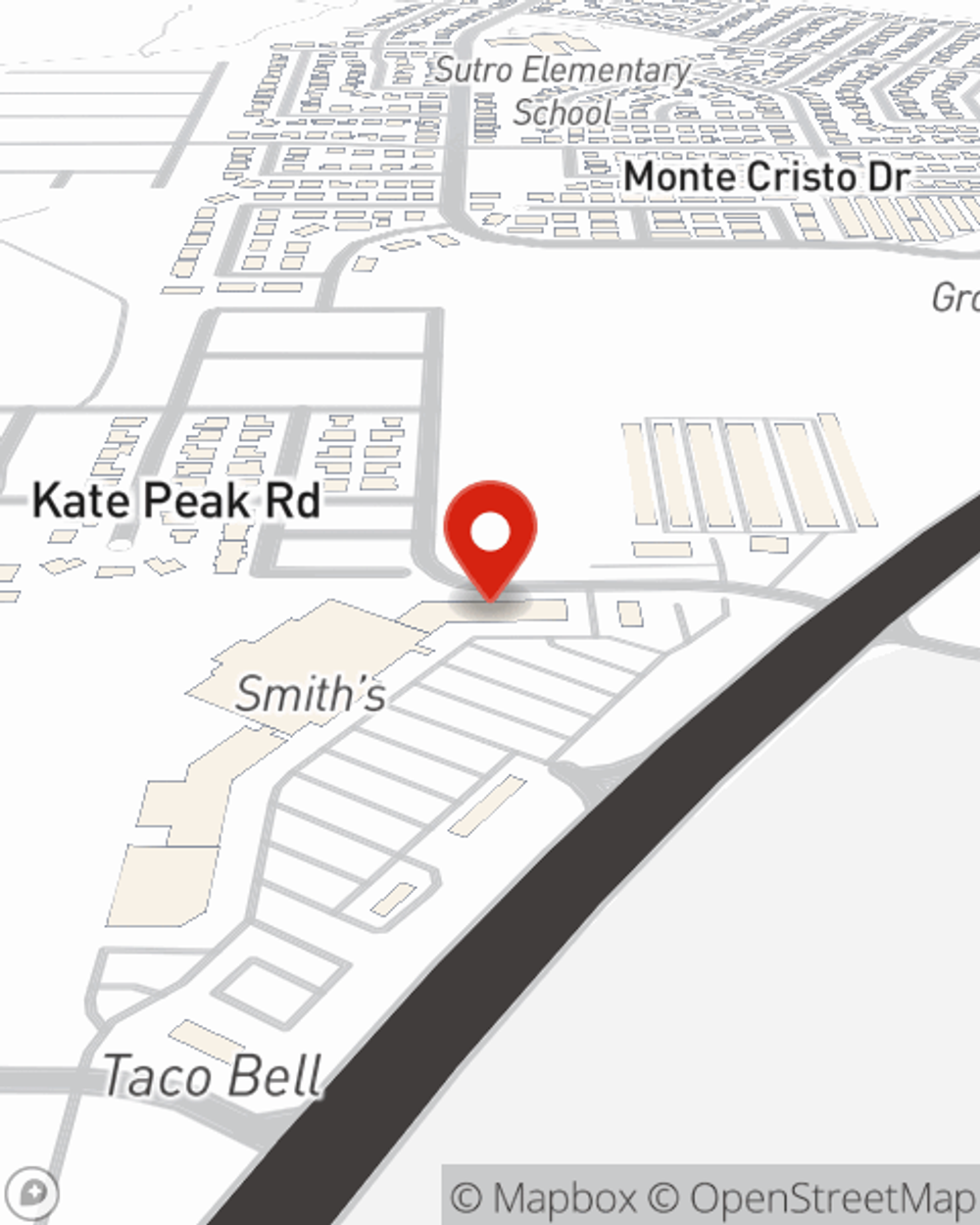

Call or email State Farm Agent Holly Hill today to see how a State Farm policy can protect your possessions here in Dayton, NV.

Have More Questions About Renters Insurance?

Call Holly at (775) 246-2777 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.